Japans rise on the world stage was severly halted in the early 90’s by monetary forces,no matter the history or how its perceived they suffered a liquidity crisis. The Japanese have been around a long time and use that time wisely, even though they where forced to the brink after booming they had enough stored away to invest in new technology and completely reform the economy which they undertook with vigor.

With this new revamped system things had to change and dramatically, so future generations would not be made susceptiable to what had occurred.They learnt a lesson that what is given can be easily taken away by a more powerful force.They returned to the Art of Zen instead of the excessess of capital greed, they reviewed the mistakes learnt how the enemy had defeated them and planned to next move.

The BoJ became one with the government, all social decisions are discussed with the BoJ there is no separation of powers here this is Zen economics 101.After rebuilding, retooling and re educating they carried excessive debt, the managers of this transformation end had came and it was time for the Samurai to rise and take control,it was time to take advantage and not be the advantage.

The Boj installed Haruhiko Kuroda a jovial personality who hasnt stopped laughing since he took the position, he immediately adjusted to game and unleashed 3.4 trillion dollars around the world, it was perfectly timed as debt was being raised by everyone,assets where still being privatised and sold so he and the Japanese people entered the world markets.The idea was simplistic in design why put your own people through the ringer again when you can just grab capital globally through interest payments then compound it in that country.Essentially they split the economy in two one offshore and another inhouse,the latter would always be the priority. but like any trade, timing is everything and its the removal of the trade that will create the yield.

So now with twin economies the real games began around 2013. Kuroda controlled QE but the easing was done depressing yields in his market that caused a massive distortion in sovereign debt markets, this rattled Japanese funds who sort offshore havens,its was reported as crazy at the time but after the initial thrust into the global communtity be the BoJ it was time the other economy he was running divested as well and the outflows where over 206 tn Yen. The gains offshore would be better than onshore the BoJ signalled they will never tighten.

The massive movement of capital from the worlds 3rd largest economy had quickly snared a portfolio that was the largest diversification of assets globally, they had the most UST, they hold 10% of Aussie debt, 8% of NZ securities, 7% Brazillian Debt.The securities portfolios are astonishing its estimated they own 2% of US,Netherlands,SG and theUK stock markets not including power stations rail and other assets.Before the world realised what the total came to the trade had been done.Zen

The debt had been enormous but now traders from the Japan where working the world markets extracting returns that couldnt be achieved onshore,while economists and funds kept saying Japan was on the brink even to today they maintained the course.The global pandemic stopped the world while other countries printed ,the BoJ didnt change its direction. When reality hit and inflation begun the elite economies started raising the interest and extracting more from the periphery,Kuroda stated at the time not in Japan they werent playing the game. This was not how to play and immediately the Bond vigilantes entered but they where quickly kicked out as the BoJ started liquidating UST and propping the bond markets, this plunged the Yen into a spiral and the world thought it was Japan who would sink first.They simply missed the move,a lower yen meant when selling US assets they got more Yen on the return.

The BoJ had signalled its next move and Japanese funds started rolling out as well taking advantage of the lower Yen, they kept up a furious pace of buying there own debt with the repatriation they where going in house and had formed a Matrix that was now rippling through the world, they hadnt fallen , at a meeting of CB’s Kuroda was directly asked in front of the press when will they reverse course, his answer was chilling to those there , first task is to look after the Japanese people and ensure their wealth is insulated from the outside, and to that extent we will be arguing for pay increases to make up the burden and will be paid by the companies.This is the opposing view of what should have been done. The line was drawn

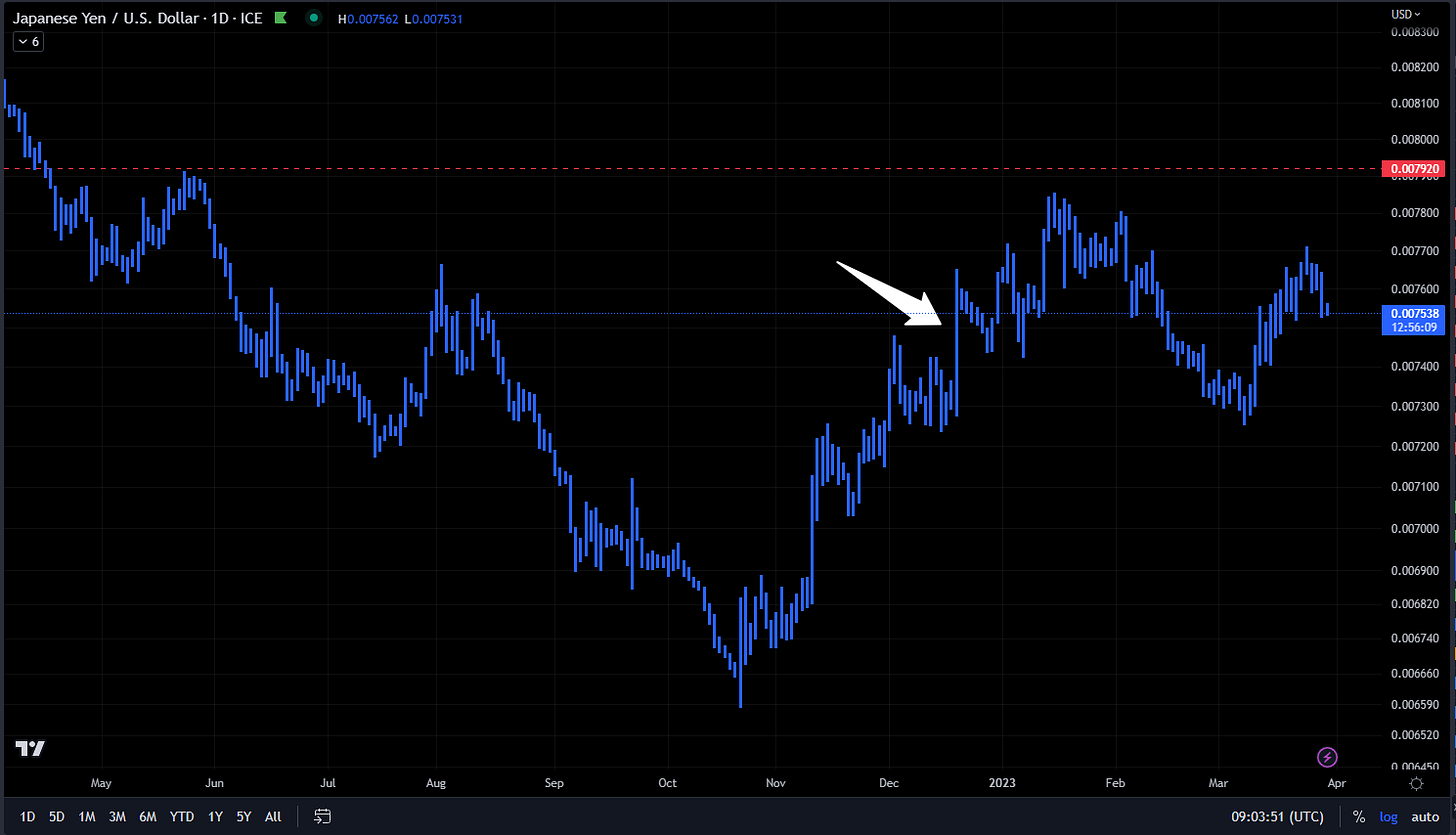

Obviously behind closed doors is never known but the heat was being applied and the Zen traders of the BoJ never talk politics or involve themselves in any retorical speech, Japan announces a deal with the sanctioned country for energy, increases trade with China and keeps repatriating its sovereign back into Yen, and this is culminating in the end trade, with the new multi polar system and Japan , its nearing time for them to release the bond market from the grip of the BoJ, the Samurai has done his job its time for a new leader which will build the BoJ in house, time to remove partial gains offshore as there will be oppotunity again inhouse.The rug is being pulled and the world are well aware of its consequences.Kuroda had a sense of humour, in December looking back there where two small trials from the BoJ but he let off the big gun before he left,He relaxed his grip ever so slightly on yields and let them float within two hrs bonds dumped and the Yen jumped, the ripple effect affected treasuries and currencies instantly. It was an experiment to see how much distortion they could create globally it cam in at 120 minutes

The chart above shows the test but also shows the Yen went on bid coming into Nov.

While the talkers continue to condone the BoJ and Japanese economic woes ,it must be noted that the smart money is moving into Yen and bonds especially the last 6 weeks, historic over subscriptions for bonds and foreign movement into bonds at all time records. The bigend arent being bought by the retoric, in fact they want in on the trade.

Obviously my view is opposite of the narravtives but whether it goes either way the cause will have the same effect, add this to the BRICS++ which is constantly turning the vice its not far off that something has to give. As far as BRICS goes today France acknowledged the purchase of gas in Yuan the first of many I would imagine, its coming to a point now of you cant fight everyone.

You need to do more of these Syt. So informative, thanks again for sharing.

Another interesting article. Thanks very much!