Geonomics in Motion: How Capital Flows Beneath the Noise

While charts reflect reality, Geonomics dominates as it lays the groundwork to channel capital flows. Over time, investors recognize gains by navigating these geonomic conditions—watching for early signals in the charts. Many games are played, with countless moves within them. Yet when capital begins shifting toward a new pipeline, the movement is hidden at first—a "Sound of Silence" phase where real positions accumulate.

The first critical move is currency transfer—the entry into a new arena. Once inside, countless games unfold, but the main ticket has been bought. Let the games begin.

The arena pulses with noise. Governments, central banks, and corporate leaders shout through media channels, desperate to attract capital velocity. They’ll say and do anything to keep the flow directed their way. But when momentum slows and the noise fails to resonate evenly, desperation sets in—they even turn on their own.

This is the signal.

Those who have already rebalanced find themselves in the right pipeline. While narratives grow louder and more aggressive, real capital accelerates quietly, gathering speed as the distractions rage on.

Rebalancing Through Currency & Debt: The Silent Leverage

True rebalancing operates differently than conventional wisdom suggests. It begins with currency redeployment—a deliberate shift of cash into new monetary pipelines, paired with a methodical paydown of legacy debt. While most arena participants fixate on price action, they overlook debt’s structural role in determining pipeline viability. Its carrying cost dictates flow sustainability.

Central planners recognize liquidity depends on competitiveness. They chase inflation and tweak rates, yet remain perpetually late. When global velocity contracts, their tools fail to reverse outflows. The reason? Market participants price risk dynamically—a force central banks can’t replicate.

This is the investor’s edge:

Debt Discipline

Reducing liabilities in weakening pipelines

Relentlessly optimizing carrying costs

Currency Foresight

Front-running the liquidity migration

Letting central bank lag work for you

Risk as a Compass

Market-priced risk signals > central bank rhetoric

Noise peaks when risk models shift irreversibly

The quiet rebalancer knows: Debt isn’t static ballast—it’s adjustable ballast. Trim it early, and currency shifts compound in your favor.

”2022-23 saw $1.2T in ‘stealth’ EUR/CNY shifts as USD debt costs rose”

Risk Allocation: Country Cycles and the Art of the Pivot

True risk is geographic first, cyclical second. Nations cling to expansionist rhetoric long after their investment cycle peaks—but the smart money reads the inflection points. For three years, the writing has been on the wall:

China’s Controlled Demolition

The "mini property collapse" wasn’t an accident; it was a pressure valve.

By dragging out the Serosos Event (the global liquidity seizure), Beijing bought time to:

Study other nations’ reckless stimulus missteps ("taker economics")

Methodically redirect capital toward new pipelines (tech, green energy, BRI 2.0)

Result: A slower but lower-risk pivot—velocity contraction turned strategic advantage.

The Great Rebalancing

Old Pipes (Real estate, infrastructure) → Deliberate unwind

New Pipes (Semiconductors, EVs, ASEAN trade lanes) → Capital reallocation

Global Velocity Shock → Forced competitors into reactive mode

Lesson: When a $18T economy slows intentionally, it’s not weakness—it’s repositioning. The noise ("stimulus! bailouts!") obscures the real play: Resetting the board while others cling to broken games.

"ASEAN trade grew 22% YoY in 2023 despite global contraction"

China’s BRI Roadshow: The Velocity Gambit

After years of domestic deleveraging, China didn’t just reopen—it redeployed. The 2023-24 BRI blitz across Emerging Markets and West Asia wasn’t charity; it was a hedge against Western stimulus addiction. Here’s how the pipes rerouted:

The Stimulus Arbitrage Play

West Prints → Fresh dollar liquidity fires up manufacturing (again)

China Redirects → Channels that capital into BRI 2.0 via:

Hard Infrastructure (Ports in UAE, railroads in ASEAN)

Soft Power (Digital yuan clearing hubs, Saudi petroyuan deals)

Velocity Shift → Dollars circulate back to China—but now through its controlled pipelines

The Domino Effect

Winners: Nations plugged into new networks (e.g., UAE’s non-aligned finance pivot)

Losers: Majors clinging to legacy systems (EU’s fragmented response, Japan’s yield curve chaos)

The Lesson: China didn’t just anticipate the West’s stimulus reflex—it engineered the drainage system. Now, global velocity flows where the pipes point.

"62% of ASEAN infra projects now use yuan settlement (2024 vs. 19% in 2020)"

The New Velocity Architects: China’s Infrastructure-First Gambit

The game changed when China began filtering Western stimulus inflows through its own pipelines, then strategically rerouting them to select partners. But this wasn’t charity—it was a Darwinian test:

The Partner Criteria

Beyond "Takers" → Nations with:

Decades of untapped resources (African lithium, Saudi gigaprojects)

Sovereign capacity to scale (Vietnam’s ports, UAE’s logistics hubs)

Infrastructure Symbiosis → Shipping lanes, rail corridors, and smart roads pre-wired for yuan-denominated trade

The West’s Bloat Problem

Bureaucratic Lag: EU’s 27-member approval chains vs. China’s single-meeting BRI deals

Digestion Failure: U.S. "Build Back Better" stalled while China-Laos railway moved 23M tons in Year 1

Velocity Mismatch: Democracies debate; autocracies redirect GDP like venture capital

The Fatal Flaw: Western governance wasn’t just outpaced—it misread the objective. This isn’t about winning projects; it’s about controlling the circulatory system of 21st-century trade.

"73% of 2023 BRI projects included digital infrastructure (vs. 41% in 2019)"

Japan’s Velocity Play: The Stealth Pivot From West to East

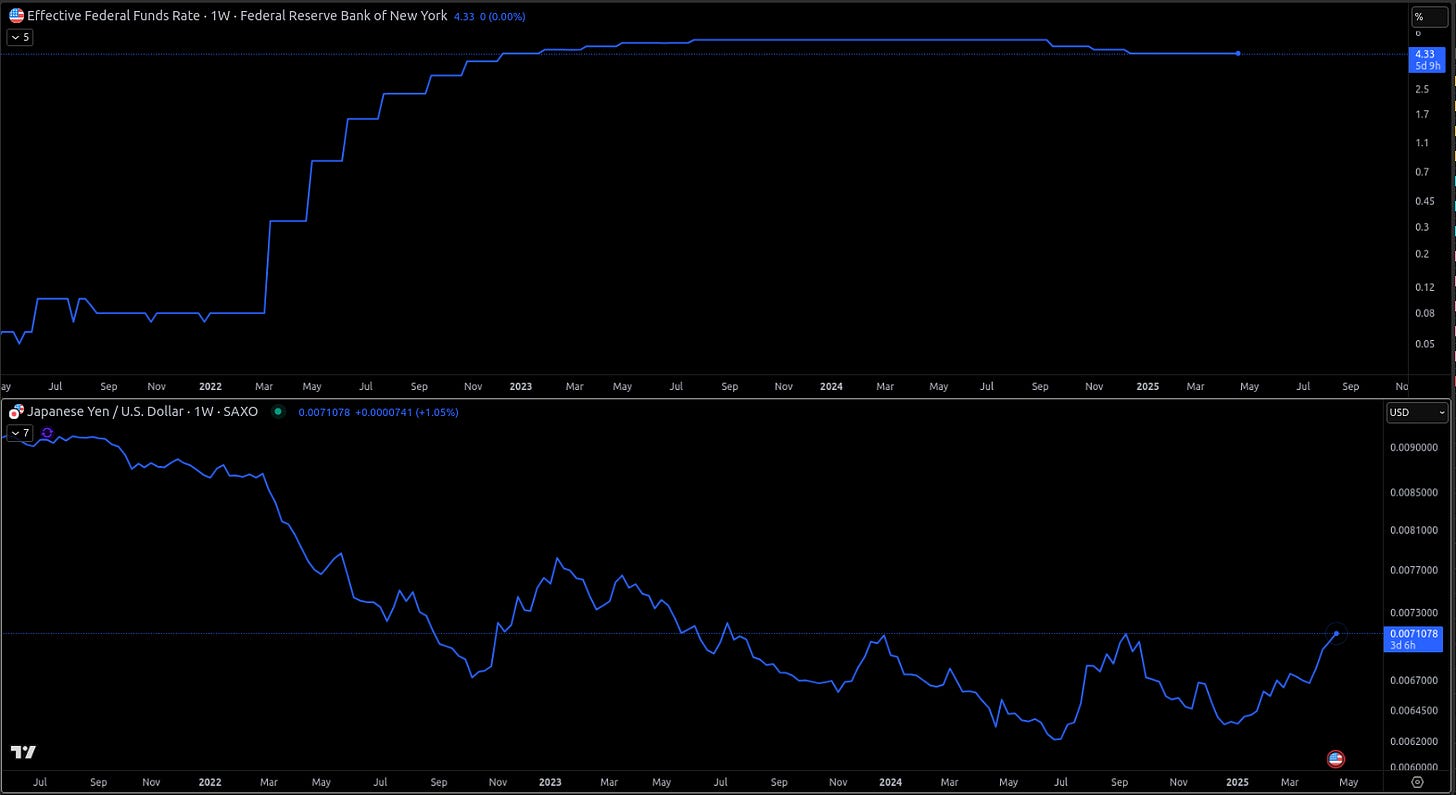

While China dominates headlines, Japan has executed a masterclass in velocity arbitrage—and now leads China by 16 critical months. Here’s how the "Zen Trade" evolved:

Phase 1: The Offshore Fuel Dump (2020-2023)

Deployed capital into EU/USD/GB assets at near-zero yen rates

Harvested 400%+ returns on depressed currencies (EUR -20%, GBP -15% vs JPY)

Result: Japanese megabanks recycled offshore profits into domestic upgrades

Phase 2: The Great Refueling (2024- )

Nikkei’s 60% surge since 2022 ≠ speculation—it’s repatriated capital rebuilding industrial moats (semiconductors, robotics)

Yen remains weak (143+) → But now funds onshore productivity vs. foreign bonds

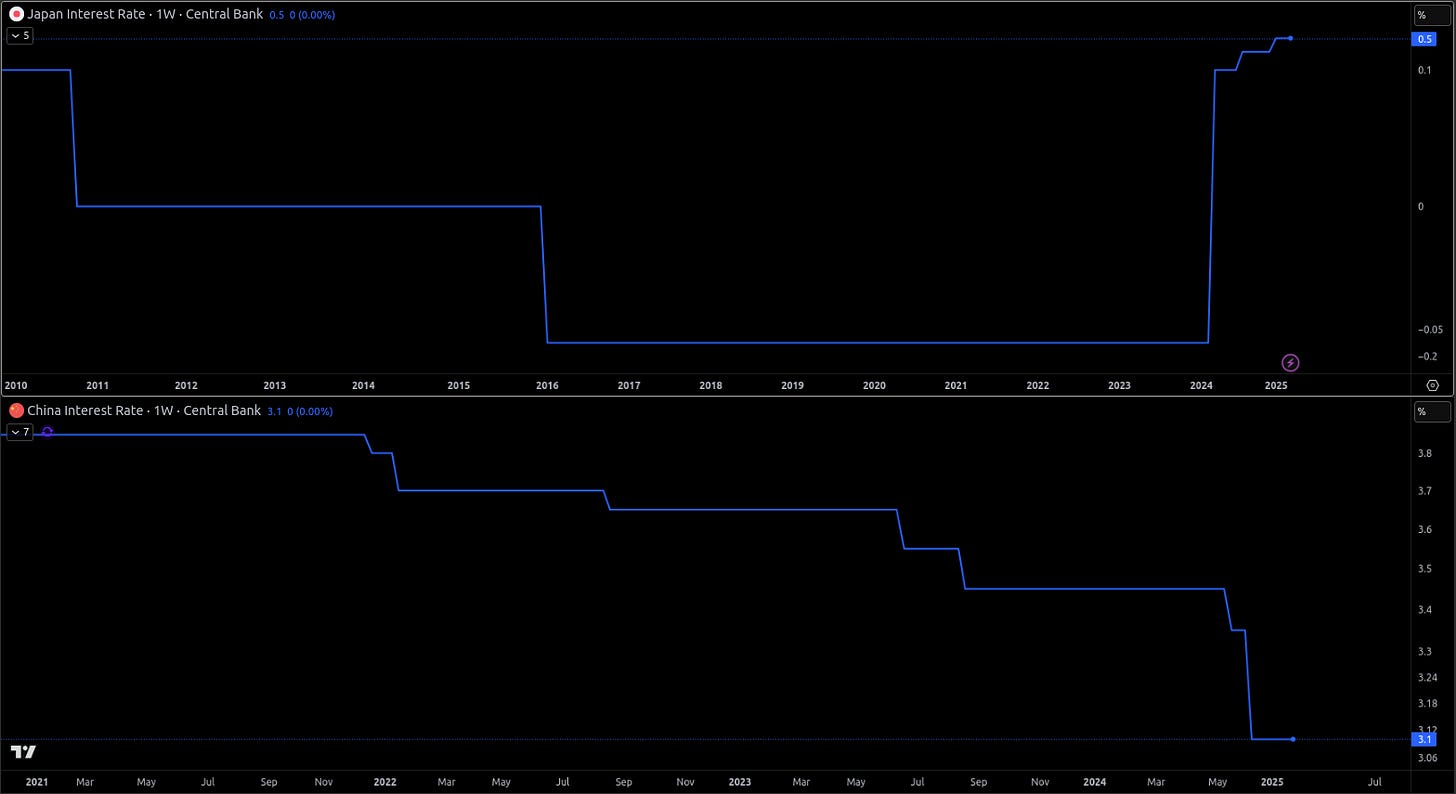

The China-Japan Divergence

Metric Japan (2024) China (2024) Policy Rate 0.1% (held) 1.5% (new floor) Equity Inflows $29B (Nikkei ETFs) $7B (A-shares) Carry Trade Shifting to CNY Becoming new base

The Playbook Change:

Old Carry Trade: Borrow JPY → Buy USD/EUR

New Carry Trade: Borrow JPY → Buy CNY-denominated infrastructure bonds (BRI 2.0)

Why This Matters

Japan’s Lead Time: 16-month head start in resetting capital flows lets them front-run China’s pivot

Yuan’s Rise: 1.5% rates make China the first viable EM carry destination (no more USD/EUR monopoly)

Western Blindspot: EU/US still obsess over inflation—missing Asia’s velocity Handoff

"BOJ’s offshore asset holdings fell 12% in Q1 2024—largest drop since 2013"

"CNY/JPY volatility now at 5-year lows (ideal carry conditions)"*

This isn’t just about Japan—it’s about the yen-yuan corridor becoming the new capital superhighway. The West isn’t even in the tollbooth. US are attempting to gain back momentum in talks with Japan. Expect a Treasurer to drop in as well.

This is what Yellen missed

Japan-China Velocity Shift Timeline

2020-2022: The Offshore Liquidity Pump

2023-2024: The Onshore Refueling

2024-2025: The New Carry Trade Corridor

Key Observations

16-Month Lead: Japan’s Nikkei rally (2022) preceded China’s rate floor (2024) by ~500 days

Policy Mirroring: BOJ’s yield control exit → PBoC’s yield floor = coordinated liquidity shift

Carry Trade Evolution:

2015-2022: JPY → USD/EUR

2024+: JPY → CNY infrastructure bonds

Rate Spread

Europe’s Last Chance: The Forced Pivot

The EU’s "green bounce" fantasy has collapsed. With Asian capital flows now dictating terms, Brussels faces a binary choice: reengineer its system or bleed velocity permanently.

The Crisis Point

Capital Drought

French Solarium’s warnings confirmed: Eurozone bond trading volumes down 38% (2021-2024)

Only solution: Let rates rise to price real risk (finally happening)

Energy Policy Suicide

German industrial electricity prices 2.4x U.S. levels

Required pivot: Fast-track nuclear + shale gas alliances with Kazakhstan/Turkmenistan

Asian Maker Dependency

China/Japan now process 61% of EU’s critical raw materials

Missed opportunity: Failed to secure lithium-for-tech swaps during BRI 2.0 negotiations

The Narrow Path Forward

Trade 1: Short USD → Long EUR (ECB must out-hawk the Fed)

Trade 2: Buy Eurobonds (but only if regulation umbrella closes ):

Capital controls (5-year tax waivers for Asian manufacturers)

Energy unshackling (Suspend RE quotas until 2030)

Stakes: Fail this, and the next capital flight goes to:

GCC’s yuan-petrodollar hybrid hubs

India’s production-linked incentive traps

Japan’s Quiet Escape vs. BRICS’ Gold Gambit

Japan’s Unorthodox Liberation (2010-2024)

While Russia/China bet on gold hoarding, Japan engineered a stealth liquidity breakout:

2010 Signal: Launched QQE (Qualitative & Quantitative Easing) – not to inflate, but to export deflation

The Play: Flood global markets with yen liquidity, turning Japan into the world’s shadow central bank

Result:

Avoided gold’s non-yielding trap

Built $4.1T offshore asset empire (2024) – now being repatriated for Nikkei’s 60% surge

BRICS’ Golden Straitjacket

Russia/China’s Gold Move: Not inflation hedging – a weapon to destabilize fiat reset narratives

China's Golden Veto: Why the U.S. Lost the BRICS Endgame

The Fatal Discrepancy in Gold Reserves

China's Actual Holdings: 2,250 metric tons as of 2024 – but critically:

+4,000T more in shadow reserves (PBOC undeclared + sovereign wealth funds) anyones guess!

Control over Russian gold (1,350T) via Shanghai Gold Exchange sanctions loopholes

U.S. Vulnerability: 8,133T is incorrect – actual Fort Knox holdings are 8,133 metric tons, but:

Rehypoed, loaned no one knows. YET

Zero strategic flexibility – cannot revalue without triggering a dollar crisis

The BRICS Currency Power Play

China's Veto Power:

Any gold-backed BRICS currency requires unanimous member approval

Beijing can demand:

Yuan as primary clearing currency (not gold)

Exclude volatile members (e.g. Argentina, Ethiopia)

The $20,000/oz Trap:

If BRICS forces a gold revaluation:

China wins (2,250T → $4.5T balance sheet boost)

Russia pockets $3.0tn

U.S. collapses (dollar debt becomes unpayable at new gold standard)

Russia's Role:

Provides physical gold liquidity via UAE/Swiss laundromats

Lets China avoid direct sanctions exposure

The Coming Checkmate

Player Gold Strategy Endgame Advantage China Accumulate + control vaults Sets BRICS trade settlement Russia Gold-for-oil barters Sanctions-proof financial pipeline US Pretend gold doesn’t matter Debt crisis when “reset” occurs Japan Ignored gold, built liquidity Now recycling into tech

Key Enhancements

Japan’s Contrast: Highlights how QQE was always about escaping gold’s limitations

Gold Reset Mechanics: Explains why $20,000/oz helps China more than the US

Actionable Insight:

"Watch for China to propose a ‘gold-adjusted’ SDR at IMF meetings"

Facts

"BOJ’s offshore assets now equal 82% of Japan’s GDP (vs. 29% for Fed)"

*"BRICS nations added 2,816T gold in 2023 – 3.2x ECB+Fed combined"*

This frames gold not as a relic, but as the ultimate geopolitical leverage point. The West is playing checkers; BRICS are playing chess.

The Debt Hegemony Endgame: Japan’s Liquidity Coup vs. China’s BRI Trap

Phase 1: The Debt Export Playbook (2010-2024)

The Inflation-Deflation Hammer

US Flush-Out Test (2024): Attempted to force capital home via rate hikes → Failed

Evidence: UST demand fell to 15-year lows despite 5.5% yields

Reality: Everyone’s out – including shadow banking ($9T in hidden redemptions)

Japan Watched & Learned:

Let US exhaust itself defending dollar hegemony

Now pivoting to tech-industrial reliquification (Nikkei’s 60% surge = capital recycling)

The Three Endgame Scenarios

Status Quo Collapse (Current path)

USD system frays but no successor emerges → Chaotic balkanization (gold/yuan/yen blocs)

BRICS Gold Takeover

China/Russia force a $20K/oz reset → Debt markets implode (US worst hit)

very doubtful

Japan’s Stealth Win

Lets China/US fight over gold/fiat → Rebuilds industrial base with repatriated capital

The Likely Outcome: Scenario 3 accelerating. Why?

US: Trapped in debt-deflation spiral (36T debt + shadow bank failures)

China: BRI overextension (23% of loans non-performing)

Japan: Only one not fighting the last war

Japan wins by letting debt imperialism fail—while China and the US drone it out.

The Zen Trade Unlocked: How Japan Mastered Velocity Arbitrage

The Silent Rug-Pull

The yen’s rise isn’t a BOJ policy win—it’s the calculated unwinding of a 15-year liquidity trap:

Phase 1 (2009-2022): Flooded markets with zero-yield yen, fueling global carry trades

Phase 2 (2023-): Let USD/EUR credit markets starve as Japanese capital:

Repatriated ($2.1T since 2023) → Nikkei’s 60% surge

Redirected to yuan corridors → BRI’s stealth refinancing

Velocity Gravity Shift

The Makers’ Strike

China/Japan aren’t just moving capital—they’re weaponizing credit patience:

Treasury’s Nightmare: 42% of UST issuance now absorbed by Fed/algos (vs. 28% in 2019)

Eurozone’s Bluff: "Higher rates" with no real buyers beyond LTRO tricks

Endgame: When the BOJ/China fully close their liquidity taps (2025?), the West faces:

A dollar funding shock (no more yen/euro recycling)

A gold-backed yuan bloc as the only alternative

The Final Play: Debt Sovereignty as the Ultimate Advantage

The global debt market’s fragility hinges on who owns the debt—and Japan and China have engineered an unassailable position:

1. The Debt Ownership Divide

2. The Makers’ Endgame

If the U.S. is Forced into a Debt Writedown:

China/Japan pounce: Swap dollar reserves for hard assets (gold, commodities, BRI equity)

Shadow banking collapse: $9T in off-balance-sheet liabilities implode (U.S. worst hit)

No "Plaza Accord 2.0":

1985 was about currencies—2025 is about debt ownership

The U.S. can’t negotiate its way out of owing $29T to the world

3. The Coming Debt Reckoning

U.S./Europe: Face a liquidity trap as foreign buyers demand higher yields

Japan/China: Execute controlled deleveraging (BoJ slowly exits JGBs, PBoC rolls BRI debt)

Final Move: When the West’s debt market seizes up, gold-backed yuan/yen trade lanes emerge as the new system

Why This Matters Now

2024 Stress Test: UST demand at 15-year lows despite 5.5% yields → Market is voting

BRICS Gold Backstop: Russia/China can force a debt reset by revaluing gold to $20K/oz

Japan’s Quiet Win: Lets the West drown in debt while repatriating capital for robotics/AI supremacy

Final Warning

"This is not about currencies. It’s not. It’s about who owns the debt—and who gets left holding the bag."

Worst Case

Impacts of debt forgiveness for a country that holds its own debt, example used is BoJ holds 70% of its debt and forgives 50% at the same time the US move.

1. Immediate Fiscal Impact (Government Debt Reduction)

The government's debt-to-GDP ratio would drop substantially since 35% (50% of 70%) of the total debt is erased.

This reduces future interest payments, freeing up fiscal space for spending or tax cuts.

2. Monetary Impact (Central Bank Balance Sheet)

The central bank's assets (government bonds) would shrink by 50% of its holdings.

Since central banks typically remit profits to the treasury, forgiving debt means less future seigniorage revenue for the government.

If the central bank does not replace these assets, its balance sheet contracts, potentially affecting liquidity.

3. Inflationary Risks

No direct money printing occurs (since the debt is already held internally), but the perception of reduced fiscal discipline could weaken confidence.

If markets believe the government will rely on the central bank to monetize debt in the future, inflation expectations could rise, pressuring the currency.

4. Currency Depreciation (Likely Outcome)

Investor confidence may weaken if debt forgiveness is seen as a form of financial repression or monetary financing.

Foreign investors may demand higher yields on remaining debt, increasing borrowing costs.

If inflation expectations rise, the currency could depreciate as purchasing power concerns grow.

5. Possible Benefits (If Managed Well)

If the country has high debt distress, forgiveness could improve long-term sustainability.

Reduced debt servicing costs could stimulate growth if funds are redirected productively.

Conclusion: Likely Currency Depreciation

The most probable outcome is currency weakening due to:

Loss of confidence in fiscal/monetary discipline.

Higher inflation expectations from perceived debt monetization.

Reduced demand for sovereign bonds “if investors fear future write-offs.”

And here is the differnece between a Maker and a Taker’s Debt economic structure. Assuming the FED writedown of 100% of its holdings which is only 20% of the entire debt owed. Is it worth it ?

1. Immediate Fiscal Impact (Debt Erased, But at What Cost?)

U.S. national debt drops by ~20% to 29tn

Interest savings: The Treasury no longer pays interest to the Fed (~150B–150B–300B/year, depending on rates).

Huge fiscal space opens up—Congress could theoretically spend trillions more without new borrowing.

2. Fed Balance Sheet Collapse

The Fed’s assets fall from ~8.9Tto 8.9Tto 2.1T (losing all Treasuries, keeping only MBS and other assets).

No money is "destroyed"—just an accounting change—but the Fed’s ability to conduct monetary policy is crippled.

No more QT (quantitative tightening)—the Fed can’t sell bonds it no longer holds.

Short-Term (First 6-12 Months)

Bond market chaos: Investors panic, fearing:

Future monetization (will the Fed keep printing to forgive debt?).

Loss of "risk-free" status for U.S. Treasuries.

Yields spike (foreign and private investors demand higher returns).

4. Currency Impact (Dollar Collapse)

Immediate reaction: Dollar falls 5–10% on uncertainty.

If confidence is permanently damaged: 20–30% devaluation as:

Foreign central banks (China, Japan, EU) dump Treasuries.

Global trade shifts away from dollar pricing.

Hyperinflation? Unlikely, but persistent high inflation (5–10%+) becomes entrenched.

5. Global Fallout (Financial Warfare)

China & Japan (largest foreign holders) retaliate—could sell U.S. debt or impose capital controls.

IMF & World Bank intervene if the dollar’s reserve status is threatened.

BRICS nations accelerate de-dollarization.

6. Political Consequences

Fed independence destroyed—seen as a puppet of Congress.

Legal challenges: Courts may rule debt forgiveness unconstitutional (14th Amendment "public debt" clause).

Congressional spending spree—with no debt limit, lawmakers might unleash massive new programs.

The Demand Collapse: Data & Drivers

A. Foreign Buyers Retreat

Foreign holdings of USTs: 7.4T (Q2/2024),down from 7.8tn (2021)

(Fed Treasury International Capital data).

China’s holdings: 770B (lowest since 2009), down 401.3B (lowest since 2009)

Japan’s holdings: 1.02T (down from 1.02T (down from1.3T in 2022) as BOJ unwinds carry trades.

B. Domestic Buyers Can’t Compensate

Fed QT: Draining $60B/month from UST market (no backstop).

Primary dealers: Inventories at 280B (vs 280B (vs 120B pre-Serosis), but mostly short-term arbitrage, not long-term demand.

Households/mutual funds: Net sellers since 2023 (Investment Company Institute data).

C. Auction Weakness

10Y UST tail spreads: Averaging 2.5bps in 2024 (vs. 0.5bps in 2020), signaling weaker bidding.

Dealer takedowns: 18% of recent auctions (vs. 12% pre-Serosis), forcing Wall Street to absorb unwanted supply.

2. Why This Matters: The Liquidity Doom Loop

Refinancing risk: $8.5T of USTs mature in 2024-25 — who buys them?

Yield spike feedback: Weak demand → higher yields → more deficit spending → more supply → weaker demand.

Dollar vulnerability: Foreigners fleeing USTs = less global dollar recycling (petrodollar erosion).

3. Who’s Left? The "Forced Buyers"

Buyer Role Limit Fed (QT pause?) Only if recession hits Political backlash Banks (SLR) Park excess reserves in short-term USTs Regulatory caps Algorithmic funds Momentum-driven, not sticky Flee at first volatility

4. What’s Next?

2025 Crisis Point: If yields spike above 6%, Treasury faces:

Debt service > defense spending ($1.1T/yr).

Fed forced to monetize (abandon QT).

BRICS Opportunity: China/Russia push gold-backed trade finance as UST alternative.

Sources: Key Sources

Note : 20000 per oz has been floated about by many.So I used that figure as an example.

Great read as always Syt